Introduction

Receiving an audit notice from the Internal Revenue Service (IRS) can be one of the most daunting pieces of mail a taxpayer encounters. The immediate reaction is often fear and anxiety. However, with the right knowledge and preparation, an IRS audit is a manageable process, not an insurmountable obstacle. This comprehensive guide, written from the perspective of an experienced U.S. tax accountant, will meticulously detail how to calmly and effectively respond to an IRS audit notice, as well as provide crucial strategies for preparing your tax returns to minimize the risk of being selected for an audit in the first place. By the end of this article, you will be equipped to approach IRS audits with confidence and a clear understanding of your responsibilities and rights.

Understanding IRS Audits: The Basics

An IRS audit is a review or examination of an individual’s or organization’s accounts and financial information to ensure that information is reported correctly according to tax laws and to verify the reported amount of tax is correct. The primary purpose of an audit is to ensure tax compliance and maintain the integrity of the U.S. tax system. Audits can be triggered for various reasons, including mathematical errors on returns, discrepancies between reported income and information received from third parties (like employers or financial institutions), or certain deductions and business activities that deviate significantly from IRS benchmarks.

Types of IRS Audits

IRS audits are generally categorized into three main types, differing in their scope and the method of examination:

- Correspondence Audit

This is the most common and least intrusive type of audit, typically initiated by mail. The IRS requests additional information or documentation to support specific items on a tax return, such as certain deductions, credits, or income discrepancies. These audits usually address relatively straightforward issues and can often be resolved by mailing the requested documents. For example, if there’s a mismatch between the income reported on your Form W-2 or Form 1099 and what you reported on your tax return, a correspondence audit might be triggered.

- Office Audit

An office audit takes place at a local IRS office. The taxpayer or their authorized representative is required to attend an in-person interview and provide documentation to support specific items on their tax return. These audits typically cover more complex issues than correspondence audits, such as detailed business expenses, rental income, or capital gains from property sales. The interview format allows the IRS auditor to ask questions and review original documents.

- Field Audit

This is the most comprehensive and complex type of audit, conducted at the taxpayer’s home, place of business, or the office of their representative. Field audits are usually reserved for businesses, self-employed individuals, or those with complex tax situations, such as extensive investment activities or international transactions. They involve a thorough examination of extensive financial records, books, and accounting systems. Field audits are typically the most time-consuming and labor-intensive, often necessitating the assistance of a tax professional.

Statute of Limitations for Audits

The IRS generally has a limited time frame within which it can audit a tax return and assess additional tax. This period is known as the statute of limitations. For most tax returns, the IRS typically has three years from the date you filed your return (or the due date, whichever is later) to initiate an audit. However, this period can be extended under specific circumstances:

- Substantial Understatement of Income: If you substantially understate your gross income by more than 25% of the amount reported on your return, the statute of limitations extends to six years.

- Fraudulent Returns: If the IRS determines that you filed a fraudulent return with the intent to evade tax, there is no statute of limitations. The IRS can audit you at any time.

- Failure to File: If you fail to file a tax return, there is no statute of limitations, meaning the IRS can audit you at any point in the future.

Understanding these time limits is crucial for knowing how long to retain your records and when your audit risk for a particular tax year generally expires.

Responding to an IRS Audit Notice

The initial steps you take upon receiving an audit notice are critical and can significantly influence the outcome of the entire audit process. A calm and strategic approach is paramount.

Step 1: Thoroughly Understand the Notice

Upon receiving an audit notice, resist the urge to panic. Instead, carefully read every detail of the letter. Pay close attention to the following key elements:

- Type of Notice: The notice will often have a specific number (e.g., CP2000 for an income discrepancy, Letter 3176 for a formal audit initiation). These codes provide insight into the nature and potential severity of the audit.

- Tax Year(s) Under Audit: Clearly identify which tax year(s) are being examined.

- Reason for Audit and Specific Items: The letter will specify the particular items or issues the IRS is questioning or for which it requires additional information. This could range from specific deductions, business expenses, or discrepancies in reported income sources.

- Response Deadline: The IRS sets strict deadlines for responses. Adhering to this deadline is crucial to avoid automatic assessments or further complications.

- Requested Documents: The notice will include a list of documents the IRS requires. Start gathering these documents promptly.

Step 2: Remain Calm and Prepare Methodically

Once you understand the notice, proceed with the following preparatory steps:

- Do Not Ignore the Notice: This is perhaps the most critical piece of advice. Ignoring an IRS audit notice will almost certainly lead to an unfavorable outcome, including an assessment of additional taxes, penalties, and interest, often without the opportunity to dispute them later.

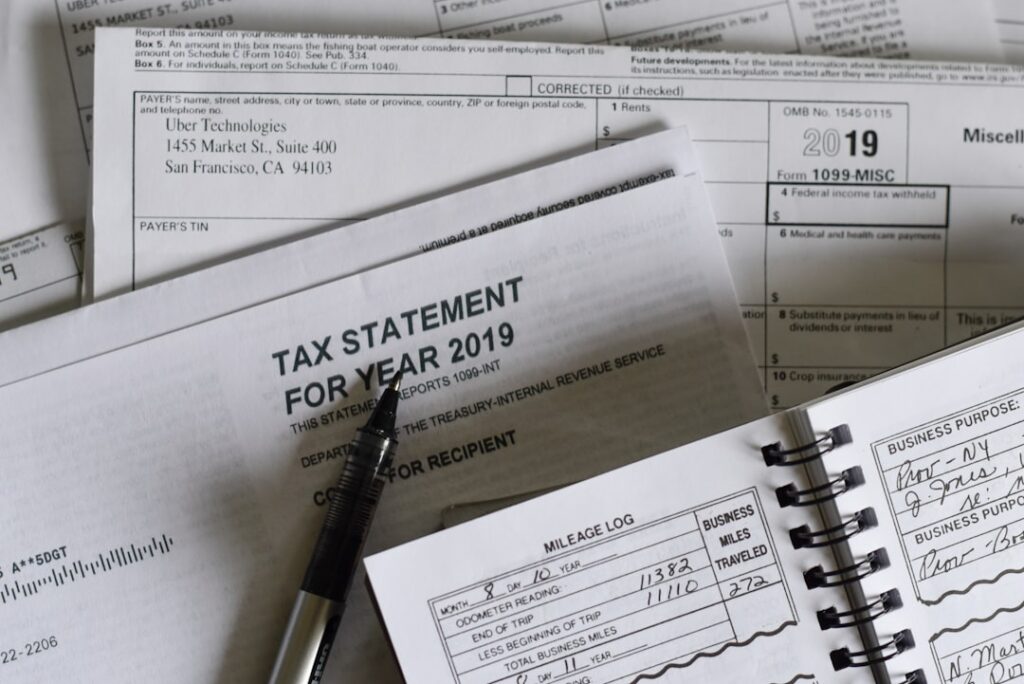

- Organize and Gather Relevant Documentation: Collect all records pertinent to the tax year(s) and items under audit. This includes your copy of the tax return, all related Forms W-2, 1099, K-1, bank statements, credit card statements, receipts, invoices, contracts, investment account statements, mortgage interest statements, and any other documents that support your reported income, deductions, and credits. Organize these documents chronologically and by category. Any notes or worksheets used during the preparation of your original return can also be valuable.

- Review Your Tax Return: Go through your copy of the tax return for the audited year(s) and refresh your memory on how the questioned items were reported and why. This review will help you anticipate potential questions and formulate your responses.

Step 3: Consider Professional Assistance

IRS audits can be complex, requiring in-depth knowledge of tax law and negotiation skills. In many situations, seeking professional help is a highly advisable strategy.

- Who Can Help?

- Certified Public Accountant (CPA): CPAs are licensed accountants specializing in financial reporting, tax preparation, and advisory services. Many have extensive experience representing clients before the IRS.

- Enrolled Agent (EA): An EA is a tax professional authorized by the IRS to represent taxpayers in all tax matters before the IRS, including audits, appeals, and collections. They are specifically trained in tax law.

- Tax Attorney: Tax attorneys are lawyers specializing in tax law. They are particularly valuable for complex legal interpretations, tax litigation, or when there is a suspicion of tax fraud.

- Benefits of Hiring a Professional: Professionals can alleviate stress, save you time, leverage their expert knowledge of tax law, negotiate on your behalf with the IRS, and protect your taxpayer rights. It is highly recommended to engage a professional if the audit is complex, involves a substantial amount of potential additional tax, or if you simply feel overwhelmed and lack confidence in handling it yourself.

Step 4: Respond to the IRS

Whether you hire a professional or decide to handle the audit yourself, adhere to these principles when communicating with the IRS:

- Communicate in Writing (Preferably): While the IRS may call, it’s generally best to respond in writing whenever possible. Written communication provides a clear record of all correspondence. Always send copies of documents, not originals, and keep a complete copy of everything you send for your records. Use certified mail with a return receipt requested to prove that the IRS received your submission.

- Answer Questions Accurately and Concisely: Provide only the information specifically requested by the IRS. Avoid offering unsolicited information, making assumptions, or engaging in emotional responses. Stick to the facts.

- Submit Only Requested Documents: Do not provide more documents than the IRS explicitly asks for. Providing extraneous information can raise new questions, potentially expanding the scope of the audit unnecessarily.

- Adhere to Deadlines and Request Extensions: Strictly observe all IRS deadlines. If you anticipate difficulty in meeting a deadline, contact the IRS (or have your representative do so) well in advance to request an extension. Extensions are often granted for reasonable causes.

- During an In-Person Interview: If your audit is an office or field audit requiring an in-person meeting, consider having your tax professional attend with you or even represent you in your absence. A professional can answer questions, ensure proper procedures are followed, and prevent you from inadvertently saying something that could complicate your case.

Step 5: Responding to Audit Results

Once the audit is complete, the IRS will issue its findings. There are generally three possible outcomes:

- No Change: This is the best outcome. The IRS agrees with your original return as filed and proposes no changes.

- Agreed: You agree with the IRS’s proposed adjustments, which typically result in additional tax due. If so, you will sign an agreement form. You may need to pay the additional tax immediately or set up an installment agreement if you cannot pay in full. Once you sign, your right to appeal is generally waived.

- Disagreed: You do not agree with the IRS’s proposed adjustments. In this situation, you have several options:

- Appeal to the IRS Office of Appeals: This is an independent office within the IRS that can review your case impartially and attempt to reach a settlement. Many disputes are resolved at the Appeals level.

- Petition the U.S. Tax Court: If you cannot reach an agreement with the Appeals Office, you can petition the U.S. Tax Court. This court allows you to dispute the IRS’s decision without having to pay the additional tax upfront. This path typically requires the assistance of a tax attorney due to complex legal procedures.

- File a Claim in Federal District Court or the U.S. Court of Federal Claims: These courts require you to pay the disputed tax first and then sue the IRS for a refund.

Preparing Tax Returns to Avoid Audits

Proactive measures to minimize audit risk are far more effective than reacting to an audit notice. By meticulously preparing your tax returns and maintaining thorough records, you can significantly reduce your chances of being selected for an audit.

Meticulous Record Keeping

Accurate and organized record-keeping is the cornerstone of audit prevention. The IRS expects taxpayers to be able to substantiate every item of income, deduction, and credit reported on their return.

- Document All Income Sources: Keep precise records of all income, whether from wages, self-employment, investments, or rental properties. Retain all third-party reporting forms such as W-2s, 1099s, and K-1s, and cross-reference them with your tax return.

- Maintain Evidence for All Expenses: For every expense you claim as a deduction, keep supporting documentation like receipts, invoices, bank statements, credit card statements, and canceled checks. This includes business expenses, itemized deductions, and charitable contributions.

- Separate Business and Personal Finances: If you are self-employed or a freelancer, maintain separate bank accounts and credit cards for your business and personal finances. This simplifies expense tracking and clearly distinguishes business-related transactions.

- Retention Period for Records: While the IRS generally recommends keeping records for at least three years from the date you filed your return, it is advisable to retain them for seven years to cover situations involving substantial understatement of income. Consider using a combination of electronic records (scanned documents, cloud storage) and physical copies for maximum security and accessibility.

Consistency and Accuracy in Reporting

The IRS uses automated systems to cross-reference information reported on your tax return with data received from third parties. Any discrepancies can trigger an audit.

- Match Third-Party Reporting: Ensure that the income and withholding amounts reported on your tax return exactly match the information on your Forms W-2 (wages), 1099 (various income types like independent contractor income, interest, dividends), and K-1 (partnership or S-corp income). Inconsistencies are a primary audit trigger.

- Accuracy of Basic Information: Double-check that all basic information, such as your name, Social Security Number (SSN), address, and dependent information, is accurate. Even minor errors can flag your return for review.

- Avoid Mathematical Errors: Review your return for any calculation errors. Using reputable tax preparation software or a qualified tax professional can significantly reduce the likelihood of such mistakes.

Avoiding Suspicious Deductions and Credits

Certain deductions and credits tend to attract more IRS scrutiny due to their potential for abuse or common reporting errors.

- Unusually High Deductions for Your Income Level/Industry: If your claimed deductions are significantly higher than the average for taxpayers in your income bracket or industry, it can raise a red flag. This is particularly true for business expenses reported on Schedule C.

- Large or Ambiguous Business Expenses: Deductions for home office expenses, vehicle expenses, travel, and entertainment are frequently scrutinized because the line between personal and business use can be blurred. Maintain meticulous records (mileage logs, purpose of travel/entertainment, attendees) to substantiate the business nature of these expenses.

- Substantial Charitable Contributions: Large non-cash contributions (e.g., real estate, artwork, stock) are often subject to intense scrutiny regarding their valuation. You must obtain a qualified appraisal, a contemporaneous written acknowledgment from the charity, and accurately complete Form 8283 for non-cash contributions exceeding $500.

- Certain Tax Credits: Credits like the Earned Income Tax Credit (EITC) and the Child Tax Credit are frequently audited due to their complex eligibility requirements and high error rates. Ensure you meet all criteria and keep all supporting documentation.

Proper Reporting of Business Income and Expenses

Self-employed individuals and small business owners filing Schedule C (Profit or Loss from Business) are often subject to higher audit rates due to the discretionary nature of reporting income and expenses.

- Report All Income Accurately: It is paramount to report all business income. Understating income is one of the most serious violations in the eyes of the IRS.

- Adhere to the “Ordinary and Necessary” Rule: Only expenses that are both “ordinary” (common and accepted in your industry) and “necessary” (helpful and appropriate for your business) are deductible. Avoid claiming personal expenses as business deductions.

- Distinguish Between Hobby and Business: If you consistently report losses from an activity that the IRS deems a “hobby” rather than a legitimate business (i.e., one engaged in for profit), your deductions may be disallowed under the Hobby Loss Rules. Demonstrate a clear intent to make a profit through business plans, marketing efforts, and financial records.

Accurate Reporting of Cryptocurrency Transactions

The IRS has significantly increased its focus on cryptocurrency (virtual currency) transactions. If you engage in crypto activities, strict adherence to reporting rules is essential.

- Record All Transactions: Keep detailed records of all cryptocurrency transactions, including purchases, sales, exchanges, and use for goods or services. Document the date, type of transaction, quantity, and fair market value in U.S. dollars at the time of the transaction.

- Report Capital Gains and Losses Accurately: Any capital gains or losses from selling or exchanging cryptocurrency must be reported on Form 8949 (Sales and Other Dispositions of Capital Assets) and Schedule D (Capital Gains and Losses).

- Respond to IRS Notices: If you receive IRS notices related to cryptocurrency (e.g., Letter 6173, 6174, 6174-A), review your tax situation carefully and consult a professional if necessary to ensure proper compliance.

Reporting Foreign Assets and Income

U.S. citizens and residents are subject to worldwide taxation, meaning they must report all income, regardless of where it is earned. Additionally, there are specific reporting requirements for foreign financial assets.

- FBAR (FinCEN Form 114): If you have a financial interest in or signature authority over foreign financial accounts, and the aggregate value of these accounts exceeds $10,000 at any time during the calendar year, you must file an FBAR with the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Treasury Department. This is separate from your tax return.

- FATCA (Form 8938): The Foreign Account Tax Compliance Act (FATCA) requires certain U.S. taxpayers to report specific foreign financial assets on Form 8938 (Statement of Specified Foreign Financial Assets) if the total value exceeds certain thresholds (e.g., $50,000 at year-end or $75,000 at any time during the year for single filers residing in the U.S.).

Failure to comply with these foreign reporting obligations can result in severe penalties. International tax compliance is a high priority for the IRS, and non-compliance is a significant audit risk.

Professional Review of Tax Returns

For individuals with complex tax situations (e.g., business income, extensive investments, foreign assets, real estate transactions), engaging an experienced tax professional (CPA or EA) to prepare or at least review their tax return is highly recommended. Professionals can identify potential errors, optimize tax positions within the bounds of the law, and significantly reduce the risk of an audit.

Case Studies and Examples

To illustrate these points, let’s examine common audit scenarios and how to effectively prevent or respond to them.

Case Study 1: Self-Employed Home Office Deduction Audit and Prevention

Scenario: Ms. A, a freelance web designer, operated her business from her home. She claimed a home office deduction for a 200-square-foot room in her residence.

Reason for Audit: Home office deductions are a common target for IRS audits because distinguishing between personal and business use can be challenging. In Ms. A’s case, the IRS suspected that the room claimed as an office was also used for personal hobbies.

Audit Issues: The IRS auditor determined that Ms. A’s home office did not meet the “exclusive and regular use” test. She could not sufficiently prove that the room was used solely for business purposes. Furthermore, she had deducted the full amount of utilities and internet expenses, failing to properly apportion them between business and personal use for the entire home.

Outcome: A portion or all of Ms. A’s home office deduction was disallowed, resulting in additional tax liability and penalties.

Audit Prevention Strategies:

- Strict Exclusive Use: Designate a specific room or area used exclusively for business. For instance, avoid using the office for personal dining when guests visit or as a play area for children. Maintain a clear physical and functional separation.

- Regular Use Documentation: Keep a calendar, appointment logs, or a business diary to demonstrate that the space is used regularly for business activities. Documenting work hours and tasks performed in the home office can be valuable.

- Accurate Apportionment: Precisely calculate the percentage of your home’s total area that your home office occupies. Apply this percentage to deductible expenses like rent, mortgage interest, property taxes, utilities, and internet. Do not claim expenses for the personal portion of your home.

- Consider the Simplified Option: The IRS offers a simplified option for the home office deduction. This allows eligible taxpayers to deduct $5 per square foot of home office space, up to a maximum of 300 square feet ($1,500). While it might result in a smaller deduction than actual expenses, it significantly reduces record-keeping burdens and audit risk.

Case Study 2: Large Non-Cash Charitable Contribution Audit and Prevention

Scenario: Mr. B, a high-income individual, donated an antique valued at $100,000 to a local museum. He claimed a substantial charitable contribution deduction and attached Form 8283 to his tax return.

Reason for Audit: Non-cash charitable contributions, especially high-value ones, are frequently audited because the valuation of donated property can be subjective and prone to manipulation. The IRS scrutinizes whether the reported value genuinely reflects the item’s fair market value.

Audit Issues: The IRS auditor found that the appraisal report Mr. B submitted did not fully meet IRS requirements (e.g., the appraiser was not “qualified” by IRS standards, or the appraisal method was not clearly documented). Additionally, Mr. B lacked sufficient records of the antique’s original purchase and the acknowledgment letter from the museum was vague, failing to clearly describe the donated item or confirm no goods/services were received in return.

Outcome: A portion or all of Mr. B’s charitable contribution deduction was disallowed, leading to additional tax and penalties.

Audit Prevention Strategies:

- Qualified Appraisal: For non-cash contributions exceeding $5,000, obtain a qualified appraisal from an independent appraiser who meets IRS criteria (as outlined in Publication 561). The appraisal should be conducted no earlier than 60 days before the donation date and no later than the due date of the return (including extensions). The appraisal report must clearly state the appraiser’s qualifications, the valuation method used, and a detailed description of the donated item.

- Accurate Form 8283 Completion: Complete Form 8283 (Noncash Charitable Contributions) accurately, providing all requested details about the donated asset, the appraiser, and the donee organization. This form is mandatory for non-cash contributions over $500.

- Contemporaneous Written Acknowledgment: Obtain a contemporaneous written acknowledgment from the charity for any single contribution of $250 or more. This acknowledgment must state the amount of cash and a description (but not value) of any non-cash property contributed, and whether the organization provided any goods or services in return for the contribution (and if so, an estimate of their value).

- Retain Purchase Records: Keep records of the donated asset’s original purchase price and acquisition date, as these can help substantiate its value during an audit.

Pros and Cons

When facing an IRS audit, choosing whether to hire a professional or handle it yourself, and proactively preparing your tax returns to avoid audits, each comes with its own set of advantages and disadvantages.

Pros and Cons of Hiring a Professional for IRS Audit Response

Pros:

- Expert Knowledge and Experience: Professionals possess deep understanding of complex tax laws and IRS audit procedures, enabling them to navigate the process effectively.

- Reduced Stress and Time Savings: They handle the arduous tasks of organizing documents, communicating with the IRS, and researching tax codes, significantly reducing your personal burden and saving valuable time.

- Enhanced Negotiation Power: Experienced professionals are skilled negotiators who can advocate for your best interests, potentially leading to a more favorable outcome than if you represented yourself.

- Protection of Taxpayer Rights: They are knowledgeable about taxpayer rights and can ensure that the IRS adheres to proper procedures, protecting you from unwarranted demands.

Cons:

- Cost: Professional fees for audit representation can be substantial, especially for complex or prolonged audits.

- Disclosure of Information: You will need to share detailed financial and personal information with your chosen professional.

Pros and Cons of Handling an IRS Audit Yourself

Pros:

- No Professional Fees: You save money by not incurring fees for tax representation.

- Increased Tax Knowledge: Handling the audit yourself can deepen your understanding of tax laws and the audit process.

Cons:

- Risk of Unfavorable Outcome: Lack of expertise in tax law and audit procedures can lead to costly mistakes and an unfavorable outcome.

- Significant Time and Effort: You will spend considerable time and effort organizing documents, communicating with the IRS, and researching relevant tax codes.

- Emotional and Psychological Burden: Directly dealing with the IRS can be a highly stressful and emotionally draining experience.

- Lack of Negotiation Skills: Without professional negotiation experience, you might be at a disadvantage when discussing adjustments with IRS auditors.

Pros and Cons of Proactively Preparing Tax Returns to Avoid Audits

Pros:

- Reduced Audit Risk: Accurate and well-supported tax returns significantly lower your chances of being selected for an audit.

- Peace of Mind: Knowing your tax affairs are in order provides confidence and reduces anxiety about potential IRS scrutiny.

- Accurate Financial Picture: Meticulous record-keeping and proper reporting give you a clearer and more accurate understanding of your financial situation.

Cons:

- Time and Effort for Record Keeping: Maintaining thorough and organized records consistently requires ongoing time and effort.

- Professional Fees (if applicable): If you engage a professional for tax preparation or review to ensure compliance, there will be associated costs.

Common Pitfalls and Cautions

Understanding and avoiding common mistakes during an IRS audit can be as crucial as knowing the correct procedures.

- Ignoring the Notice: This is the gravest error. Ignoring an IRS notice will almost invariably lead to an automatic assessment of additional taxes, penalties, and interest, often without recourse.

- Panicking and Responding Impulsively: Avoid emotional reactions. Instead, take time to understand the notice, organize your thoughts, and plan your response based on facts and documentation.

- Providing More Information Than Requested: Stick strictly to what the IRS asks for. Supplying extra, unrequested information can introduce new questions, potentially broadening the scope and complexity of the audit unnecessarily.

- Inadequate Record Keeping: This is a primary cause of unfavorable audit outcomes. Without proper documentation to substantiate your income, deductions, and credits, the IRS will likely disallow them.

- Lying or Misleading an IRS Agent: Even unintentional misrepresentation can be viewed as an attempt to defraud the government, leading to severe penalties, including criminal prosecution. Always be honest and accurate in your communications.

- Missing Deadlines: Failure to respond by the specified deadline can result in automatic assessments, additional penalties, and a loss of your right to appeal. Always request an extension if you cannot meet a deadline.

- Failing to Seek Professional Advice: For complex cases or if you feel overwhelmed, attempting to handle an audit alone can be a costly mistake. The fees for professional representation often save you money in the long run by preventing larger tax assessments and penalties.

Frequently Asked Questions (FAQ)

Q1: How far back can the IRS audit me, and what increases my chances of being audited?

A1: Generally, the IRS can audit your tax return for up to three years from the date you filed it (or the due date, whichever is later). For example, a 2023 tax return filed in April 2024 could be audited until April 2027. However, this period extends to six years if you substantially understate your gross income by more than 25%. There is no statute of limitations for fraudulent returns or if you fail to file a return at all.

Several factors can increase your likelihood of being audited:

- High-Income Earners: Individuals with higher incomes often have more complex tax situations (e.g., extensive investments, multiple businesses), which can attract IRS scrutiny.

- Self-Employed Individuals (Schedule C Filers): These taxpayers face higher audit rates because they report their own income and expenses, offering more discretion in what is claimed. Consistently reporting losses from a business can also trigger an audit.

- Claiming Significant Deductions or Credits: Deductions that are unusually high for your income level or industry average (e.g., large home office deductions, substantial charitable contributions, excessive business expenses) can raise red flags.

- Discrepancies with Third-Party Reporting: Any mismatch between the income or withholding reported on your W-2s, 1099s, or K-1s and what you report on your tax return is an immediate audit trigger for the IRS’s automated systems.

- Cryptocurrency Transactions: The IRS is actively scrutinizing cryptocurrency activities for proper reporting of gains and losses.

- Undisclosed Foreign Assets or Income: Failure to report foreign bank accounts (FBAR) or foreign financial assets (FATCA Form 8938) can lead to severe penalties and a high risk of audit.

- Prior Audit Issues: If you’ve been audited before and issues were found, you might be more likely to be audited again.

Q2: What are my options if I disagree with the IRS audit findings?

A2: If you disagree with the IRS’s proposed adjustments after an audit, you have several avenues to pursue:

- IRS Appeals Office: Your first step is typically to appeal the decision to the IRS Office of Appeals. This office is independent of the audit division and aims to resolve tax disputes fairly without litigation. Many cases are settled at the Appeals level through negotiation.

- U.S. Tax Court: If you cannot reach an agreement with the Appeals Office, you can petition the U.S. Tax Court. This court allows you to litigate your case without having to pay the disputed tax upfront. This option often requires the assistance of a tax attorney due to the complex legal procedures involved.

- Federal District Court or U.S. Court of Federal Claims: You also have the option to file suit in a Federal District Court or the U.S. Court of Federal Claims. However, unlike the Tax Court, you must first pay the disputed tax in full before filing a lawsuit in these courts.

Regardless of the path you choose, it is crucial to consult with a tax professional (CPA or tax attorney) to discuss your specific situation and evaluate the best course of action.

Q3: Can I change my tax representative during an audit?

A3: Yes, absolutely. As a taxpayer, you have the right to change your representative at any point during an IRS audit or any other interaction with the IRS. This might be necessary if you are dissatisfied with your current representative, if your case requires a different specialization, or for any other reason.

To change representatives, you will need to inform your new tax professional of your situation, and they will typically file a new Form 2848 (Power of Attorney and Declaration of Representative) with the IRS. This form officially notifies the IRS that a new representative has been appointed and that all future communications should be directed to them. For a smooth transition, it’s often beneficial for your new representative to communicate with your previous one to ensure all relevant information and documents are transferred.

Conclusion

While an IRS audit notice can undoubtedly be unsettling, it is not an insurmountable challenge when approached with adequate knowledge and preparation. The most crucial steps upon receiving such a notice are to remain calm, thoroughly understand its contents, and respond accurately and promptly within the given deadlines. Do not hesitate to seek the assistance of a qualified tax professional, such as a CPA, Enrolled Agent, or Tax Attorney. They can serve as your invaluable advocate, navigating the complexities of tax law and protecting your rights during negotiations with the IRS.

Ultimately, the most effective strategy against an IRS audit is proactive prevention. Diligent record-keeping, ensuring the accuracy and consistency of your tax returns, prudently claiming deductions, and seeking professional review for complex tax situations are key elements in strengthening your tax compliance. These preventive measures not only significantly reduce your audit risk but also provide invaluable peace of mind, allowing you to file your tax returns with confidence. Prevention is indeed the best defense, and by adhering to these guidelines, you empower yourself to confidently manage your tax obligations.

#IRS Audit #Tax Compliance #Tax Preparation #Tax Advice #Audit Prevention #US Tax #Taxpayer Rights #Tax Accountant